While nobody can predict what 2025 holds for agriculture, today’s economic trends and past cycles provide valuable insights for thinking about farm equipment purchases. AgDirect, one of the leading equipment financing programs in the nation, looks at some of the key factors shaping on-farm income and decisions.

Equipment has gotten more expensive.

Price matters when purchasing new farm equipment. Since 1990, the average price of a new tractor has outpaced the rate of inflation. The average price of a 200-horsepower tractor has risen 287% and the price of a new 300-horsepower tractor, 275% -- double the rate of inflation from 1990 to 2024.

The margin squeeze is real.

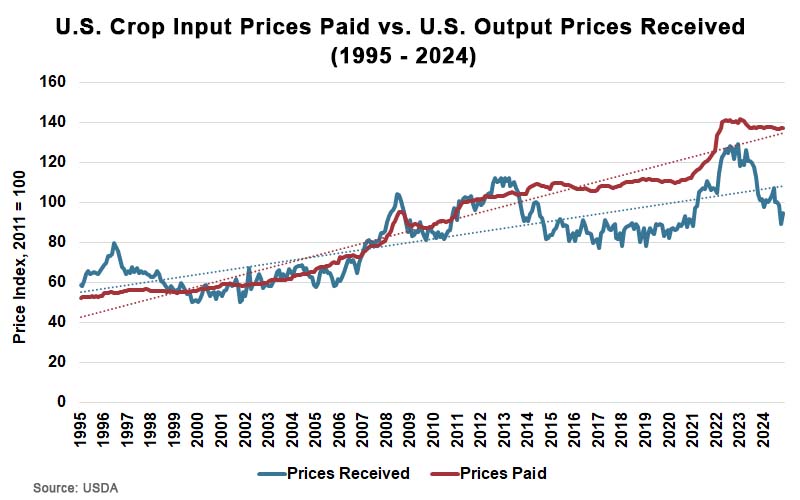

U.S. crop producers have experienced significant margin compression during the past year. Crop prices received by producers were volatile in 2024. As the chart below shows, crop prices received increased 9.5% in the first half of the year, followed by an 11.8% drop from June to November. In fact, crop prices in November were 5.4% lower than in January 2011.

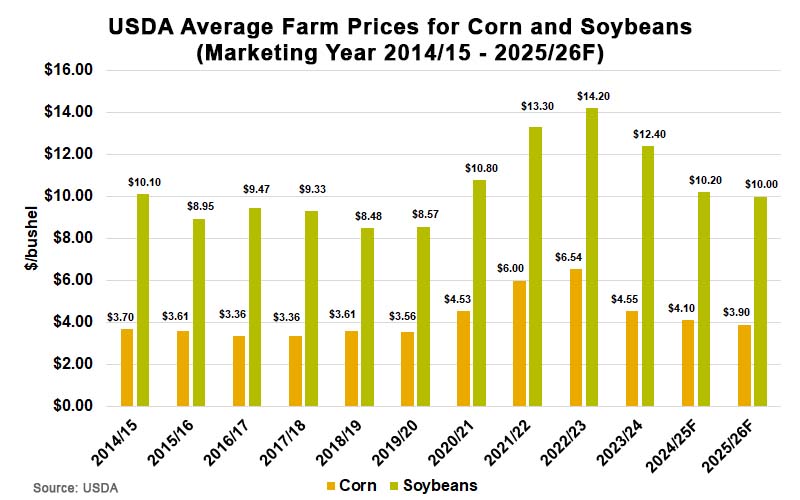

Average farm prices for corn and soybeans are projected to decline further for the 2025/2026 marketing year. Corn prices are expected to be around $3.90 per bushel and soybeans, $10 per bushel for marketing year 2025/26. This means margins will remain tight, and in some cases negative, for U.S. corn and soybean producers.

Input costs are higher.

The prices that U.S. crop producers pay for chemicals, fertilizer, farm machinery, fuels, seeds and other production costs have stayed relatively “sticky” since 2022. While crop prices at the end of the 2024 harvest were down more than 5% compared to January 2011, input prices paid were up 37.5% for the same time period.

Little relief on the interest rate front.

Meanwhile, the federal funds rate that shapes interest rates is expected to drop only 50 basis points in 2025, far less than the 150 basis points projected last fall. Interest rates are at more historically normal levels but have added to the cost of financing at a time when producers also face higher production costs.

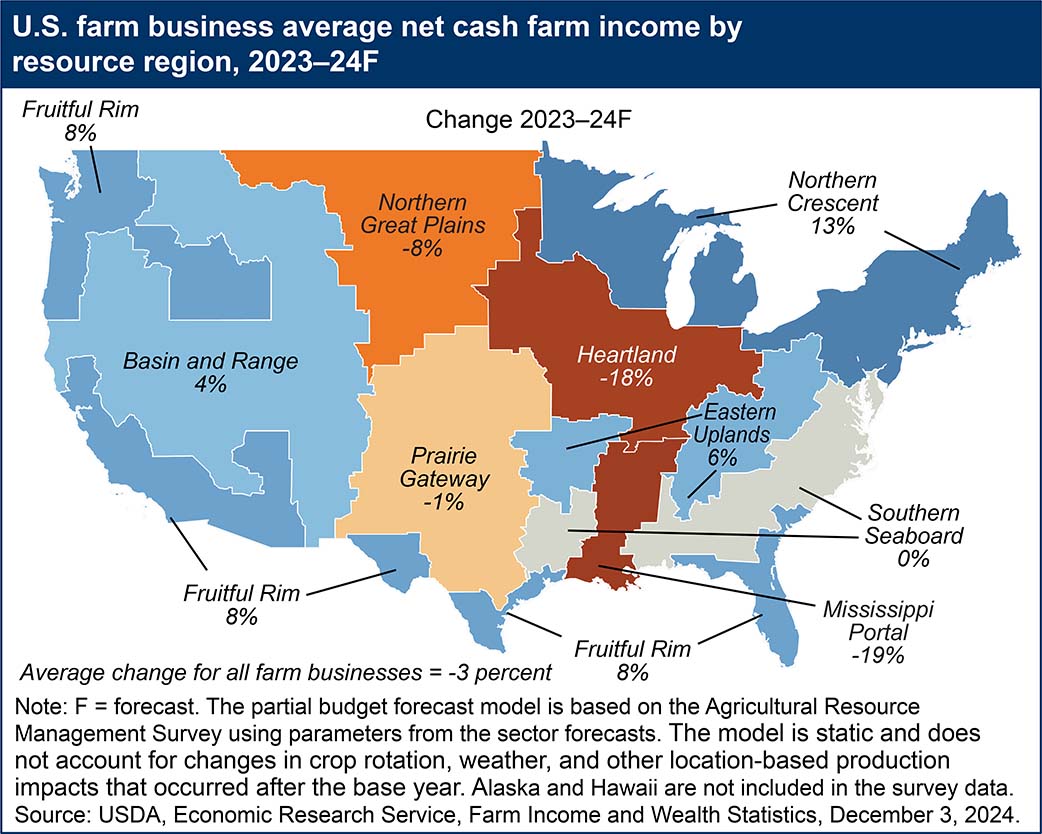

Net cash farm income is down.

Net cash farm income is cash receipts from farming and cash from farm-related income (such as government payments) minus cash expenses. On an inflation-adjusted basis, average net cash income for farm businesses, USDA projects a decline of nearly 20% -- or $30,000 – from 2023 to 2024 for producers in the heartland region, as shown in the map below. If accurate, this would be the largest year-over-year decline in percentage terms since 2013 to 2014.

A three-year rolling average for net cash farm income in the heartland region (graph below) offers yet another perspective. It is down, but by a relatively more modest 13%. It reflects positive cash receipts from farming, as well as significant government payments.

Producers entered the current downturn in the grain market with unprecedented levels of working capital and balance sheets are still positive. However, lower commodity prices and higher production costs likely will eat into working capital in 2025.

When adjusted for inflation, average net cash farm income nationally for corn and soybean producers is expected to be at its lowest level since 2010, the first year this data was collected. Average net cash farm income for all U.S. corn farms is forecast to be down 35% from 2023 to 2024, while income from soybeans is expected to decline 36% year-over-year.

What this means for equipment purchases in 2025.

While the economic outlook is challenging, proactive planning, strong risk management and strategic management can help farmers mitigate some of these pressures. But preserving working capital will be top of mind, and this will shape purchasing decisions.

Farm equipment sales in 2025 likely will be mixed as commodity price pressures impact producer margins.

Used Equipment Market: Producers may be hesitant to purchase new or used equipment until they get a handle of their working capital situation putting pressure on the new and used equipment market. Machine prices are expected to remain solid as inventory levels stabilize. This might suggest that demand for used equipment may be higher than the new equipment market, providing opportunities for farmers looking to upgrade without the high costs of new machinery.

New Equipment Sales: The outlook for the new equipment market is more cautious. Economic pressures, tight margins, and high input costs may lead farmers to delay purchasing new machinery. However, advancements in precision agriculture and smart farming technologies could drive interest in specific high-tech equipment.

Auction Market: The auction market may remain active, with many farmers considering retirement or restructuring their operations. This could lead to increased availability of used equipment at auctions, potentially at competitive prices.

Overall, new and used equipment sales might face some headwinds in 2025 due to tight margins. However, with the increase in equipment inventory over the past couple years along with lower producer demand, equipment prices may also be under pressure Farmers should carefully evaluate their needs and financial situation to make informed decisions about equipment investments in 2025.

For more on ag equipment decisions in 2025, download AgDirect’s used equipment buying guide.